Friday, April 22, 2016

Friday, April 15, 2016

7 Things That Lure Traders to Their Doom

New traders come to trading excited about learning, and looking for a fast path to riches. The majority of new traders can make big mistakes that take their accounts to zero during their learning curve. Traders can grow their capital if they do it correctly, but there are dangers that new traders should be aware of. I hope this blog post saves you a lot of money if you are a new trader, or refreshes your memory if you find yourself tempted to play big and loose with your trading capital. Here are some of the dangers:

- Trading too large a position size due to overconfidence of an entry signal. You must limit your trade size to safe levels, and not let faith become your position size metric.

- Taking positions in markets that are not liquid enough to handle your trade size. You can lose a lot of money fast by getting in and out of a trade with a wide bid/ask spread. The options market in low volume stocks and penny stocks are the worst for this.

- Holding on to a losing trade and not taking your initial stop loss.Getting caught on the wrong side of a trend can turn a small loss into a big loss. Big losses are the number one cause of unprofitable trading.

- Adding to a losing trade. This can turn a small loss into a big loss that the ego becomes invested in holding.

- Thinking that you will get rich quick. The stronger the urge to get rich quick, the greater the odds that a new trader will take the risks that will lead them to ruin. Slow and steady wins the trading race.

- Being under capitalized. Trading an account that has not accumulated enough capital can cause a new trader to take too big of a position size, and take too many risks. Profitability will be nearly impossible, as commissions will be too high of a percentage of each trade. Serious active trading requires at least a five figure trading account. The markets will be here when you are ready.

- Trading markets you do not understand. Trading Forex, futures, or options without a full understanding of how they work, and the risks involved, is a formula for disaster. You must gain competence in these markets before you will be successful.

Avoid these dangers and stick with what you know. Trading is a marathon and not a sprint. Make sure you are running in the right direction before you start the race.

Winning Trader, Whining Trader

There are two very different types of traders, one that wins and one that whines. Whiners hardly ever win and winners rarely whine. Trading is a tough business and you have to be able to keep the right mind set to get you through the rough spots. When the markets start trying to knock you off your trading plan and system. Mental strength more than any other one thing will determine your success. You can come back from losing your whole account but you can’t come back from completely losing your faith and confidence in yourself. Your mind must be one of a winning trader . We should not entertain internal or external whining. Keep the faith, stay focused on your long term destination and what it will take to get there.

Winning traders take responsibility. Whining traders play the victim.

Winning traders take the right entries. Whining traders get in too early or too late and miss the opportunity.

Winning traders find a way to make money. Whining traders find an excuse why they did not.

Winning traders add value by entering a trading discussion. Whining traders add value by leaving a trading discussion.

Winning traders study ten times as much as they trade. Whining traders trade ten times more than they study.

Winning traders enjoy the game and the profits. Whining traders enjoy their delusions of the big score.

Winning traders build a mentor relationship. Whining traders think they are too smart for a mentor.

Winning traders are realistic about their possible returns. Whining traders are delusional about what returns are probable for them.

Winning traders are focused on their trading expertise. Whining traders are scatter brained and their style drifts to what they think will work.

Winning traders approach their trading as a business. Whining traders approach their trading as a hobby or gambling.

Winning is a state of mind as much as a winning process. Whining is trading with the wrong set of mind and feeling like a victim when the error was trading without a good long term process.

Wednesday, April 13, 2016

How I Like to Trade Bullish Gap-ups

Gaps in prices can be one of the strongest indicators of momentum and while many are using gaps as an opportunity to get out of a winning trades many times it is a great entry signal and beginning of a strong trend in the direction of the gap. Gaps work best in growth stocks especially after earnings are reported when they go into an accumulation phase but also at times in indexes as well as equities as an asset class go under accumulation. A gap signals momentum and that nobody is even willing to make a trade in the hole that is created in the chart.

- Gaps can be bought at the open for a possible quick gain and good entry but there is still a possibility that the gap could collapse and those are violent but the odds are that the right leading stock will continue in the direction of the gap. Better odds are to wait for the gap to hold for the first hour of trading then make an entry, you may get a better entry on a pull back and avoid being caught if the gap fails and price collapses. I like to buy gaps at the end of the day for the highest probability that it is a gap and go and not a gap and crap.

- Gaps in high volatility do not tend to hold and trend as well as a gap out of a clean price base.

- A gap off a key moving average or that opens over a key moving average has a better chance of success than a random gap.

- A gap into all time highs is especially powerful with all holders now in a profit and tend to just let the profits run.

- Shorts caught in gaps can add fuel to the fire of the trend as they are forced to buy to cover.

- A great place to set a stop is just under the low of the gap up day, price should not breach that level if it is going to trend. Using and end of day stop gives you better odds of not being shaken out if it just dips there temporarily.

- After the low of the day holds and a trend begins over multiple days then the trailing stop could be moved to the 10 day sma and then the 5 day ema to lock in profits but allow the trend to continue in your favor. On a very volatile stock some your the 21 day ema or 20 day sma as a trailing stock to not be shaken out of a winner for me personally that is too far away.

- Also be aware that a momentum growth stock that gaps up does not have long term resistance just pauses and higher highs, also overbought indicators are worthless in momentum growth stocks under heavy accumulation by money managers. RSI extremes can go farther than believed.

- When caught on the wrong side of a gap against you it is best to just get out in the first 30 minutes, if the gap holds and makes higher highs after the first thirty minutes of the trading day it almost always just gets worse as the day goes on.

- Gaps have a way of leaving so many retail traders on the sidelines because they think that was the move and they don’t want to chase. Some of my biggest winners were me buying into gap ups with the right position sizing and letting my winner run.

Here are four daily gap up charts I did trade successfully for profits some for big profits some for huge profits. I think it is a great exercise to look at the gap up day and see how it played out and how you would have played it for profits yourself.

Good Trades are Never Easy

Traders may be waiting for the market to settle down and give them more clarity about the trend. For the moving average to hold, for volatility to decrease, for the economic numbers to be more positive, for oil prices to find a range, for your bad luck with entries to end….

The reality is, the market action will NEVER give you the perfect time. That right moment for entry never arrives. The entry will always be difficult; right at the peak of fear the bottom is reached. When the market feels like it will never stop going up a short term top is reached.

Good traders buy the fear at the right time, they sell the greed, they go against the majority when the trend bends and they enter trades that make them uncomfortable. The profitable traders trade a system that has a mathematical and emotional edge over their opponents. Trading is never easy because the profits usually arise from signals that are counter-intuitive. Buying momentum and greed can work in an uptrend and selling short can work in a downtrend. These signals work best in the beginning of that trend, when the trade seems particularly difficult.

Profitable traders take trades when their signals are triggered, even if they don’t believe in them at that moment. They understand the historical price performance and what is possible.

Their trading plan is their boss. Their signals are their gurus. Their trading system is what gives them the faith to click their mouse and put real money at risk in the belief that they can win. They have faith in themselves and their methodology. That is how they can click the mouse and make the trade. Can you?

Tuesday, April 12, 2016

The First 12 Questions for a Trader to Answer

- What time frame will you be trading in? This establishes your needed screen time.

- What will be your specific entry signals? What price action or technical indicators will get you into a trade?

- What will be your specific exit signals after entry? Stop loss, trailing stop, or price target.

- How much are you willing to lose per trade?

- What risk/reward ratio are you looking for in your trading?

- What win percentage do you need to be profitable with your risk/reward ratio?

- What are the probabilities of a draw down with your win/loss probabilities and risk per trade?

- How many trades a month do you need ideally to hit your annual return goals?

- How much will your commission costs for your trading activity level be as a percentage of your account monthly?

- Do you have a trading system?

- Do you have a complete trading plan?

- Can you follow your plan and system with discipline?

A Big Obstacle for Traders: Time

Day traders can lose money in markets with low volatility.

Trend followers don’t make money without a trend and lose money in whipsawing markets.

Swing traders can’t make money in tight ranges.

Investors lose money in bear markets.

Option buyers need trends to make money, and option sellers need small moves in prices to make money.

If you are trading with a robust system, proven principles, and the right position size then trading can be an enjoyable and profitable experience. If you risk too much and trade too randomly, then trading can be a stressful nightmare. If your trading capital is large enough to meet your financial goals, then you can enjoy it as a sport. If you are trading with a small account and trying to pay the light bill each month, you will experience too much stress to trade with a long-term perspective.

Each trade should be just one of the next one hundred. Each trade you make today should just be one for the week. Each week should only be one week during the month. One month’s results are just one out of the entire year. Short-term results can be random; it takes time for a system to play out and to identify an edge during the right market environments that can lead to profitability.

You have to monitor your trading to ensure that you’re following your system’s entries and exits with discipline, and that you are meeting your win percentage and limiting your losses per your trading plan. Trading is about the long game and the fortitude to last long enough to reap the rewards of your efforts. Time is your test, stay with it until you win. Survival is half the battle. The other half is comprised of discipline, risk management, and a robust methodology.

Time is one of the biggest obstacles that traders will face. Success has more to do with how you manage losing streaks and drawdowns because the winning streaks are easy, but patience is the true test of a professional trader.

Monday, April 11, 2016

A Trading Plan: Do You Have One?

Successful traders have a plan to win. By carefully putting the odds in their favor for the long term, successful traders will overtake gamblers who rely on random trades and a prayer.

If you want to win in any area of life, you must be disciplined, study, and do the hard work. There are no short cuts, and especially not in trading. You need to enter the markets prepared and with a detailed plan to enable success. Here are the components of a trading plan:

The Components of a trading plan:

1. Entering a trade: You must know clearly at what price you plan to enter your trade. Will it be a break through resistance, a bounce off support, or a specific price, or based on indicators? You need to be specific.

2. Exiting a trade: At what level will you know you are wrong? Loss of support, a price level, a trailing stop, or a stop loss? Know where you are getting out before you get in.

3. Stop placement: You must either have a mental stop, a stop loss entered, a time stop alone, or a time stop with an indicator.

4. Position sizing: You determine how much you are willing to risk on any one trade before you decide how many shares to trade. How much you can risk will determine how much you can buy, based on the equities price and volatility.

5. Money management parameters: Never risk more than 1% of your total capital on any one trade. (2% maximum for aggressive traders who can handle bigger drawdowns.)

6. What to trade: Trade things you are comfortable with. Swing trading range bound stocks, trend trading growth stocks, or trend following commodities or currencies. Trade what you know.

7. Trading time frames: Are you a day trader, position trader, swing trader, or long term trend follower? If you are a long term trend follower, don’t get shaken out of a position in the first day by taking profits or getting scared. Know your holding period and adjust your plan accordingly.

8. Backtesting: Do not trade any method until you reviewed charts over a few years to see how you would have done. Alternatively, utilize backtesting software to analyze historical data for your system. There are also precooked systems like CAN SLIM, The Turtles Trading System, and many Trend Following Systems. You need to begin trading knowing you have an edge.

9. Performance review: Keep a detailed record of your wins and losses. You need to be sure that your method is working in real trading. Review this after every 20 trades. Also, if you had any issues with discipline, then make notes, learn from your mistakes, and the make necessary adjustments.

10. Risk vs. Reward: Enter high probability trades where you are risking $1 to make $3, or trade a system that wins big in the long term through trend following.

Regardless of how you trade, every trader must have a trading plan. Period.

How to be a Profitable Trader in 180 Days

This is a guest post by Rayner Teo

Let me guess.

You’re into trading because you want financial freedom, to make lots of money, and to kiss your boss’s as* goodbye.

You learn everything you can get your hands on. Trading books, courses, forums etc.

1 year has passed…

2 years has passed…

3 years has passed…

And you’re still not profitable.

The bad news is this:

Chances are, you don’t know what it takes, to succeed in this business.

And the good news?

I’m going to show you how to be profitable, step by step, within the next 180 days.

Let’s begin.

The law of large number and how it impacts your trading

First, you need to understand something called “the law of large number”.

So, what is the law of larger number?

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. – Probability Theory

And what does it mean?

This means you need a large number of trades (at least a 100) for your “edge” to play out.

It’s impossible to be consistently profitable every week, taking 7 trades a month.

Because your trading results are random in the short run, and will be closer to its expected value, in the long run.

What is consistency?

Now…

For your “edge” to play out, you need a minimum of 100 trades, for the law of large number to work in your favor.

This means:

If you want to be profitable every day, you need 100 trades a day.

If you want to be profitable every week, you need 100 trades a week.

If you want to be profitable every month, you need 100 trades a month.

So…

Let’s breakdown some of the trading approach you can employ.

High frequency trading – Trading at 10,000 times a day, you can expect to be profitable everyday, like Virtu Financial.

Day trading – Trading an average of 3 – 5 times a day, you can expect to be profitable in most quarters.

Swing/position trading – Trading an average of 5 – 15 times a month, you can expect to be profitable in most years.

The more trades you put on during a shorter period of time, the faster your “edge” will play out.

But without an “edge” in the markets, the more trades you put on, will lead you to blow up your account faster.

Understand this, and you’re ahead of 90% of traders out there.

Next…

I will share with you the exact steps on how to be consistently profitable.

Find a trading style that suits you

The best way to find out is, to read Market Wizards, by Jack Schwager.

You’ll be exposed to different trading styles by successful traders, and learn the essentials of what it takes to be a, consistently profitable trader.

Once you find a trading style that resonates with you, go all out and learn everything you can on it. (Let’s assume you want to be a successful swing trader).

Here’s how:

Books – Go to Amazon, and read books on “Swing trading”. I would suggest sticking to books with 4 stars or higher

Youtube – Watch videos on swing trading, and look for channels to subscribe to

Google – You can always find hidden gems here. Search for topics on “swing trading” and you’ll be amazed at the wealth of information available

Social Media – A gold mine here to learn from experienced traders

As you acquire trading knowledge, I would encourage you to write it down, or save it in a word document. This is to track what you’ve learnt, and to find out “the stuff” that resonates with you.

This should take you no more than 28 days.

Now…

You’re going to use these new found knowledge, and develop your own trading plan.

Are you ready?

A step by step guide to developing your trading plan

A trading plan is a set of guidelines that define your trading.

The benefits of a trading plan:

- Removes subjectivity in your trading

- Reduce “roller coaster” experiences

- Keeps you focus on your trading goals

- Allows you to identify “problems” to work on

- Prepares you for the “worst” possible scenario

Now you’re probably wondering:

How do I develop a trading plan?

By answering these 7 questions…

What is your time frame?You must define the time frames you’re trading. If you’re a swing trader, then you’ll probably be trading the 4 hour or daily time frames.

What markets are you trading?You need to state which markets you’ll be trading. It could be equities, forex, futures etc.

How much are you risking on each trade?This boils down to risk management. You must know how much you’re prepared to lose on a single trade. For starters, I would suggest no more than 1%. This means if you have a $10,000 account, you cannot lose more than $100 on each trade.

What are the conditions of your trading setup?You need to know the requirements of your trading setup. Whether you’ll trade with the trend, within a range, or both (For starters I would suggest trading with the trend).

How will you enter your trade?You could enter on a pullback or breakout. Will it be a limit, stop or market order?

Where is your stop loss?

No professional trader would enter a trade without a stop loss. The first thing you need to ask yourself is, “where will I get out if I’m wrong?”

No professional trader would enter a trade without a stop loss. The first thing you need to ask yourself is, “where will I get out if I’m wrong?”

Where is your profit target?

And if price moves in your favor, you need to know where to take your profits.

And if price moves in your favor, you need to know where to take your profits.

Disclaimer: Below is a sample trading plan that I came up with randomly, please do your own due diligence.

Sample trading plan

I’ll be using the IF-THEN syntax in my trading plan.

Example:

If I’m a boy, then I’ll wear pants.

If I’m a girl, then I’ll wear skirt.

If I’m not a boy or a girl, then I’ll be naked.

You get my point.

Let’s begin…

If I am trading, then I will only trade Eurusd and Audusd. (The markets you are trading)

If I’m trading currencies, then I’ll focus on the daily charts (Time frame traded)

If I place a trade, then I will not lose more than 1% of my account. (Your risk management)

If price is above 200 EMA on daily, then the trend is bullish. (Conditions before entering a trade and time frame you are trading)

If trend is bullish, then identify area of support where price could retrace to. (Conditions before entering a trade)

If price retrace to your area of support, then wait for a higher close. (Conditions before entering a trade)

If price closes higher, then enter long at next candle open. (Entry)

If you’re long, then place your stop loss below the low of the candle, and take profit at swing high. (Exit when you’re wrong, and when you’re right)

Developing your trading plan should take you not more than 2 days.

Execute your trading plan to be a consistent trader

Once you’ve completed your trading plan, its time to take it to the markets.

I would suggest starting really small on a live account because you’re going to suck, real bad.

And if that’s the case, why not pay lesser in “tuition fees”, to Mr Market?

Now…

When you execute your trades, 1 of 5 things can happen.

- Break even

- A small win

- A big win

- A small loss

- A big loss

If you eliminate #5, you are much closer to being a profitable trader.

Now…

You must execute your trades consistently according to your trading plan.

Because if you’re entering trades based on how you feel, instead of following your plan, then it would be impossible to tell whether your trading has an “edge” in the markets.

Secondly…

You cannot change your trading plan after a few losing trades. Even though I know you’re tempted to do so.

Why?

Because in the short run, your trading results are random. And in the long run, it’ll be closer towards its expected value.

This means you need a minimum of 100 trades, before coming up with a conclusion whether your trading plan works, or not. Recall the law of large number?

You should be able to execute 100 trades within the next 150 days.

Focus on whether what you are dong is right, not on the random nature of any single trade’s outcome. – Richard Dennis

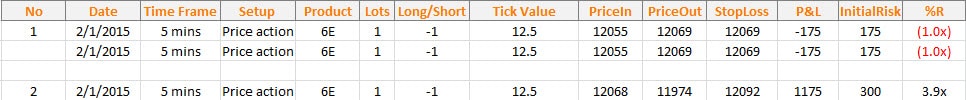

Record your trades and improve your trading performance

Simply executing your trades isn’t enough.

Because the only metric you get, is your P&L. This doesn’t help improve your trading, except knowing whether you’re making money, or not.

Here’s the metrics you should record:

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that trigger your entry

Market – Markets you’re trading

Lot size – Size of your position

Long/Short – Direction of your trade

Tick value – Value per tick

Price in – Price you entered

Price out – Price you exited

Stop loss – Price where you’ll exit when you’re wrong

Profit & Loss in $ – Profit or loss from this trade

Initial risk in $ – Nominal amount you’re risking

R – Your initial risk on the trade, in terms of R. If you made two times your risk, you made 2R.

An example below:

Screen capture your charts

After recording down your metrics, you’d want to save your charts for future reference.

Here’s how you can do it:

- Save the chart of the higher time frame

- Save the chart that you entered on

- Save the chart after the trade is completed

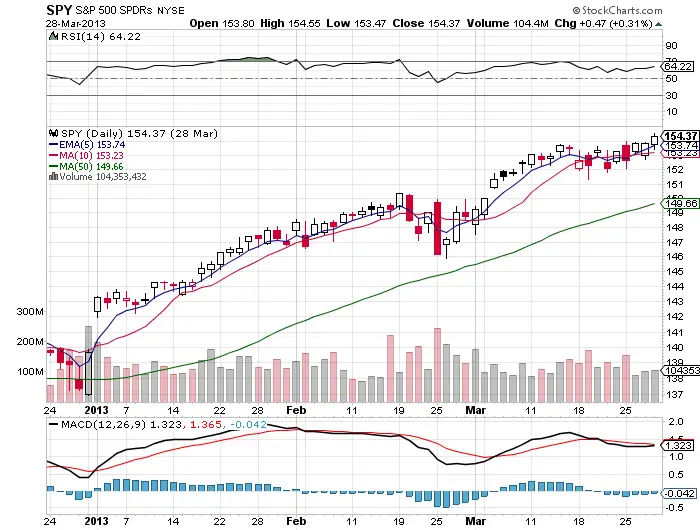

Chart of the higher time frame

This chart will give you the big picture of what’s happening. Depending on your trading style, this chart is usually one time frame above your entry time frame.

E.g. If you’re entering off daily charts, then the higher time frame would be weekly.

In this section, write down your thoughts on the higher time frame like:

- What’s the trend

- Support & resistance

- Structure of the markets

Here’s an example:

Chart of the entry time frame

This chart is the time frame you entered on. You’ll mark out the entry and stop loss of your trade.

In this section, write down your thoughts like:

- What’s the setup

- Where’s your entry

- Where is your stop loss

Here’s an example:

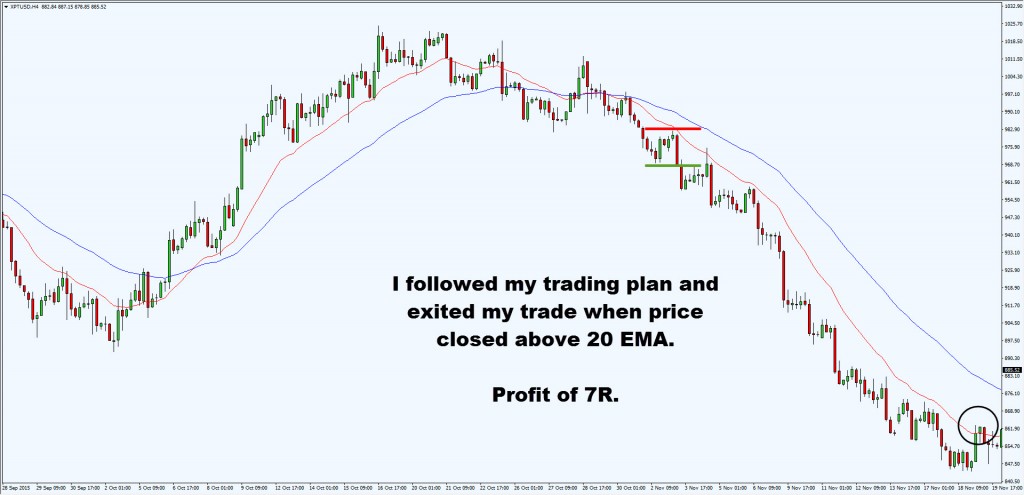

Chart after the trade is completed

After completing a trade, you’ll save the chart with your thoughts on it.

In this section, write down your thoughts like:

- Did you follow your plan

- What’s your profit/loss in R

- How did you exit your trade

- How could you improve on it

Here’s what I mean:

After recording and capturing your charts, you’re now ready to move onto the next section…

Review your trades and find your “edge”

Once you’ve executed 100 trades consistently, you can review whether your trading strategy has an “edge” in the markets.

To do so, you need to use the expectancy formula below:

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + Slippage)

If you have a positive expectancy, congratulations! It is likely that your trading strategy has an “edge” in the markets.

But what if it’s a negative expectancy?

Here’s a few things you can look at…

Trade with the trend

By trading with the trend, you’ll trade along the path of least resistance which will improve your performance.

Set a proper stop loss

You want to set your stop loss based on structure of the markets, and not the dollar amount you’re willing to risk.

Remove large losses

You can do this by risking no more than 1% on each trade.

Here’s a summary of what you’ve learnt so far…

Speed your learning curve by following these traders

Jim Rohn once said, “you are the average of the 5 people you spend the most time with.”

I couldn’t agree more.

So, if you want to improve your trading fast, then hang around with traders who are already doing it, successfully.

Follow these traders on Twitter:

Steve Burns – Trend and swing trader

Tom Dante – Futures trader (ledge)

Rolf – Founder of Tradeciety

Assad Tannous – Head Trader and founder of Asenna Wealth Solutions

Lance Beggs – Price action trader

Peter Brandt – 40 year veteran trader who trades using classical technical analysis

Rayner Teo – The one who wrote the post you’re reading now

Trading websites you must check out:

Newtraderu – Helping new traders survive

Tradeciety – Lots of tips and tricks on trading

YourTradingCoach – One of the best price action website out there

ChatwithTraders – Interviews with successful traders

TradingwithRayner – Trend following by reading price action of the markets

Conclusion

I’ve just shared with you step by step, on how to be a profitable trader within the next 180 days.

I can’t guarantee you’ll be profitable within the next 180 days. But if you follow the steps I’ve shared with you, I’m certain you’ll have a strong trading foundation that, greatly increase the odds of your trading success.

Trading success is the sum of small efforts, repeated day in and day out — R Collier

Check out more of Rayner’s work at TradingWithRayner.com or his great tweet stream @Rayner_Teo.

Subscribe to:

Posts (Atom)