This is a guest post by Rayner Teo

Let me guess.

You’re into trading because you want financial freedom, to make lots of money, and to kiss your boss’s as* goodbye.

You learn everything you can get your hands on. Trading books, courses, forums etc.

1 year has passed…

2 years has passed…

3 years has passed…

And you’re still not profitable.

The bad news is this:

Chances are, you don’t know what it takes, to succeed in this business.

And the good news?

I’m going to show you how to be profitable, step by step, within the next 180 days.

Let’s begin.

The law of large number and how it impacts your trading

First, you need to understand something called “the law of large number”.

So, what is the law of larger number?

The law of large numbers is a theorem that describes the result of performing the same experiment a large number of times. According to the law, the average of the results obtained from a large number of trials should be close to the expected value, and will tend to become closer as more trials are performed. – Probability Theory

And what does it mean?

This means you need a large number of trades (at least a 100) for your “edge” to play out.

It’s impossible to be consistently profitable every week, taking 7 trades a month.

Because your trading results are random in the short run, and will be closer to its expected value, in the long run.

What is consistency?

Now…

For your “edge” to play out, you need a minimum of 100 trades, for the law of large number to work in your favor.

This means:

If you want to be profitable every day, you need 100 trades a day.

If you want to be profitable every week, you need 100 trades a week.

If you want to be profitable every month, you need 100 trades a month.

So…

Let’s breakdown some of the trading approach you can employ.

High frequency trading – Trading at 10,000 times a day, you can expect to be profitable everyday, like Virtu Financial.

Day trading – Trading an average of 3 – 5 times a day, you can expect to be profitable in most quarters.

Swing/position trading – Trading an average of 5 – 15 times a month, you can expect to be profitable in most years.

The more trades you put on during a shorter period of time, the faster your “edge” will play out.

But without an “edge” in the markets, the more trades you put on, will lead you to blow up your account faster.

Understand this, and you’re ahead of 90% of traders out there.

Next…

I will share with you the exact steps on how to be consistently profitable.

Find a trading style that suits you

The best way to find out is, to read Market Wizards, by Jack Schwager.

You’ll be exposed to different trading styles by successful traders, and learn the essentials of what it takes to be a, consistently profitable trader.

Once you find a trading style that resonates with you, go all out and learn everything you can on it. (Let’s assume you want to be a successful swing trader).

Here’s how:

Books – Go to Amazon, and read books on “Swing trading”. I would suggest sticking to books with 4 stars or higher

Youtube – Watch videos on swing trading, and look for channels to subscribe to

Google – You can always find hidden gems here. Search for topics on “swing trading” and you’ll be amazed at the wealth of information available

Social Media – A gold mine here to learn from experienced traders

As you acquire trading knowledge, I would encourage you to write it down, or save it in a word document. This is to track what you’ve learnt, and to find out “the stuff” that resonates with you.

This should take you no more than 28 days.

Now…

You’re going to use these new found knowledge, and develop your own trading plan.

Are you ready?

A step by step guide to developing your trading plan

A trading plan is a set of guidelines that define your trading.

The benefits of a trading plan:

- Removes subjectivity in your trading

- Reduce “roller coaster” experiences

- Keeps you focus on your trading goals

- Allows you to identify “problems” to work on

- Prepares you for the “worst” possible scenario

Now you’re probably wondering:

How do I develop a trading plan?

By answering these 7 questions…

What is your time frame?You must define the time frames you’re trading. If you’re a swing trader, then you’ll probably be trading the 4 hour or daily time frames.

What markets are you trading?You need to state which markets you’ll be trading. It could be equities, forex, futures etc.

How much are you risking on each trade?This boils down to risk management. You must know how much you’re prepared to lose on a single trade. For starters, I would suggest no more than 1%. This means if you have a $10,000 account, you cannot lose more than $100 on each trade.

What are the conditions of your trading setup?You need to know the requirements of your trading setup. Whether you’ll trade with the trend, within a range, or both (For starters I would suggest trading with the trend).

How will you enter your trade?You could enter on a pullback or breakout. Will it be a limit, stop or market order?

Where is your stop loss?

No professional trader would enter a trade without a stop loss. The first thing you need to ask yourself is, “where will I get out if I’m wrong?”

No professional trader would enter a trade without a stop loss. The first thing you need to ask yourself is, “where will I get out if I’m wrong?”

Where is your profit target?

And if price moves in your favor, you need to know where to take your profits.

And if price moves in your favor, you need to know where to take your profits.

Disclaimer: Below is a sample trading plan that I came up with randomly, please do your own due diligence.

Sample trading plan

I’ll be using the IF-THEN syntax in my trading plan.

Example:

If I’m a boy, then I’ll wear pants.

If I’m a girl, then I’ll wear skirt.

If I’m not a boy or a girl, then I’ll be naked.

You get my point.

Let’s begin…

If I am trading, then I will only trade Eurusd and Audusd. (The markets you are trading)

If I’m trading currencies, then I’ll focus on the daily charts (Time frame traded)

If I place a trade, then I will not lose more than 1% of my account. (Your risk management)

If price is above 200 EMA on daily, then the trend is bullish. (Conditions before entering a trade and time frame you are trading)

If trend is bullish, then identify area of support where price could retrace to. (Conditions before entering a trade)

If price retrace to your area of support, then wait for a higher close. (Conditions before entering a trade)

If price closes higher, then enter long at next candle open. (Entry)

If you’re long, then place your stop loss below the low of the candle, and take profit at swing high. (Exit when you’re wrong, and when you’re right)

Developing your trading plan should take you not more than 2 days.

Execute your trading plan to be a consistent trader

Once you’ve completed your trading plan, its time to take it to the markets.

I would suggest starting really small on a live account because you’re going to suck, real bad.

And if that’s the case, why not pay lesser in “tuition fees”, to Mr Market?

Now…

When you execute your trades, 1 of 5 things can happen.

- Break even

- A small win

- A big win

- A small loss

- A big loss

If you eliminate #5, you are much closer to being a profitable trader.

Now…

You must execute your trades consistently according to your trading plan.

Because if you’re entering trades based on how you feel, instead of following your plan, then it would be impossible to tell whether your trading has an “edge” in the markets.

Secondly…

You cannot change your trading plan after a few losing trades. Even though I know you’re tempted to do so.

Why?

Because in the short run, your trading results are random. And in the long run, it’ll be closer towards its expected value.

This means you need a minimum of 100 trades, before coming up with a conclusion whether your trading plan works, or not. Recall the law of large number?

You should be able to execute 100 trades within the next 150 days.

Focus on whether what you are dong is right, not on the random nature of any single trade’s outcome. – Richard Dennis

Record your trades and improve your trading performance

Simply executing your trades isn’t enough.

Because the only metric you get, is your P&L. This doesn’t help improve your trading, except knowing whether you’re making money, or not.

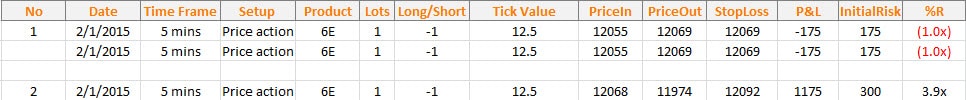

Here’s the metrics you should record:

Date – Date you entered your trade

Time Frame – Time frame you entered on

Setup – Trading setup that trigger your entry

Market – Markets you’re trading

Lot size – Size of your position

Long/Short – Direction of your trade

Tick value – Value per tick

Price in – Price you entered

Price out – Price you exited

Stop loss – Price where you’ll exit when you’re wrong

Profit & Loss in $ – Profit or loss from this trade

Initial risk in $ – Nominal amount you’re risking

R – Your initial risk on the trade, in terms of R. If you made two times your risk, you made 2R.

An example below:

Screen capture your charts

After recording down your metrics, you’d want to save your charts for future reference.

Here’s how you can do it:

- Save the chart of the higher time frame

- Save the chart that you entered on

- Save the chart after the trade is completed

Chart of the higher time frame

This chart will give you the big picture of what’s happening. Depending on your trading style, this chart is usually one time frame above your entry time frame.

E.g. If you’re entering off daily charts, then the higher time frame would be weekly.

In this section, write down your thoughts on the higher time frame like:

- What’s the trend

- Support & resistance

- Structure of the markets

Here’s an example:

Chart of the entry time frame

This chart is the time frame you entered on. You’ll mark out the entry and stop loss of your trade.

In this section, write down your thoughts like:

- What’s the setup

- Where’s your entry

- Where is your stop loss

Here’s an example:

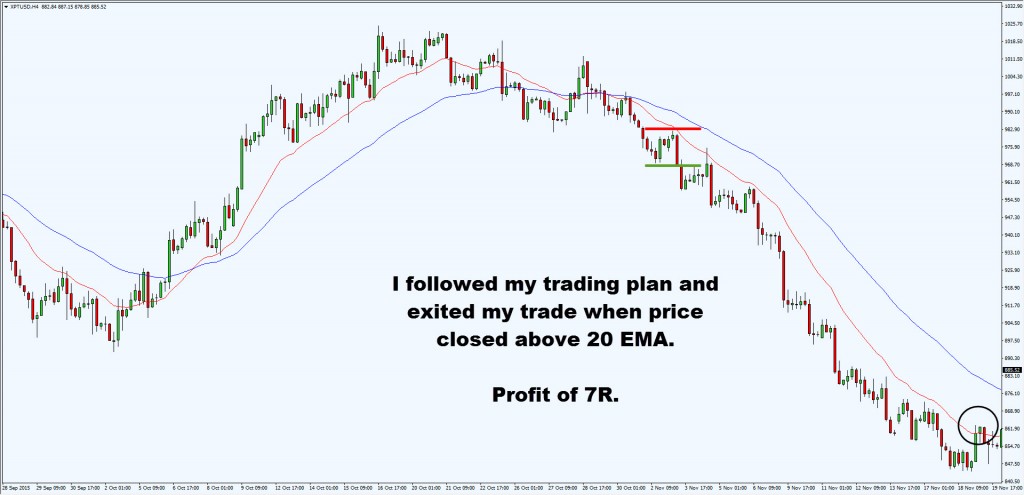

Chart after the trade is completed

After completing a trade, you’ll save the chart with your thoughts on it.

In this section, write down your thoughts like:

- Did you follow your plan

- What’s your profit/loss in R

- How did you exit your trade

- How could you improve on it

Here’s what I mean:

After recording and capturing your charts, you’re now ready to move onto the next section…

Review your trades and find your “edge”

Once you’ve executed 100 trades consistently, you can review whether your trading strategy has an “edge” in the markets.

To do so, you need to use the expectancy formula below:

Expectancy = (Winning % * Average win) – (Losing % * Average loss) – (Commission + Slippage)

If you have a positive expectancy, congratulations! It is likely that your trading strategy has an “edge” in the markets.

But what if it’s a negative expectancy?

Here’s a few things you can look at…

Trade with the trend

By trading with the trend, you’ll trade along the path of least resistance which will improve your performance.

Set a proper stop loss

You want to set your stop loss based on structure of the markets, and not the dollar amount you’re willing to risk.

Remove large losses

You can do this by risking no more than 1% on each trade.

Here’s a summary of what you’ve learnt so far…

Speed your learning curve by following these traders

Jim Rohn once said, “you are the average of the 5 people you spend the most time with.”

I couldn’t agree more.

So, if you want to improve your trading fast, then hang around with traders who are already doing it, successfully.

Follow these traders on Twitter:

Steve Burns – Trend and swing trader

Tom Dante – Futures trader (ledge)

Rolf – Founder of Tradeciety

Assad Tannous – Head Trader and founder of Asenna Wealth Solutions

Lance Beggs – Price action trader

Peter Brandt – 40 year veteran trader who trades using classical technical analysis

Rayner Teo – The one who wrote the post you’re reading now

Trading websites you must check out:

Newtraderu – Helping new traders survive

Tradeciety – Lots of tips and tricks on trading

YourTradingCoach – One of the best price action website out there

ChatwithTraders – Interviews with successful traders

TradingwithRayner – Trend following by reading price action of the markets

Conclusion

I’ve just shared with you step by step, on how to be a profitable trader within the next 180 days.

I can’t guarantee you’ll be profitable within the next 180 days. But if you follow the steps I’ve shared with you, I’m certain you’ll have a strong trading foundation that, greatly increase the odds of your trading success.

Trading success is the sum of small efforts, repeated day in and day out — R Collier

Check out more of Rayner’s work at TradingWithRayner.com or his great tweet stream @Rayner_Teo.

No comments:

Post a Comment